nanny tax calculator uk 2020

I created the Nanny Tax Calculator to. The government have a maximum allowance of 045.

Nanny Tax Payroll Calculator Gtm Payroll Services

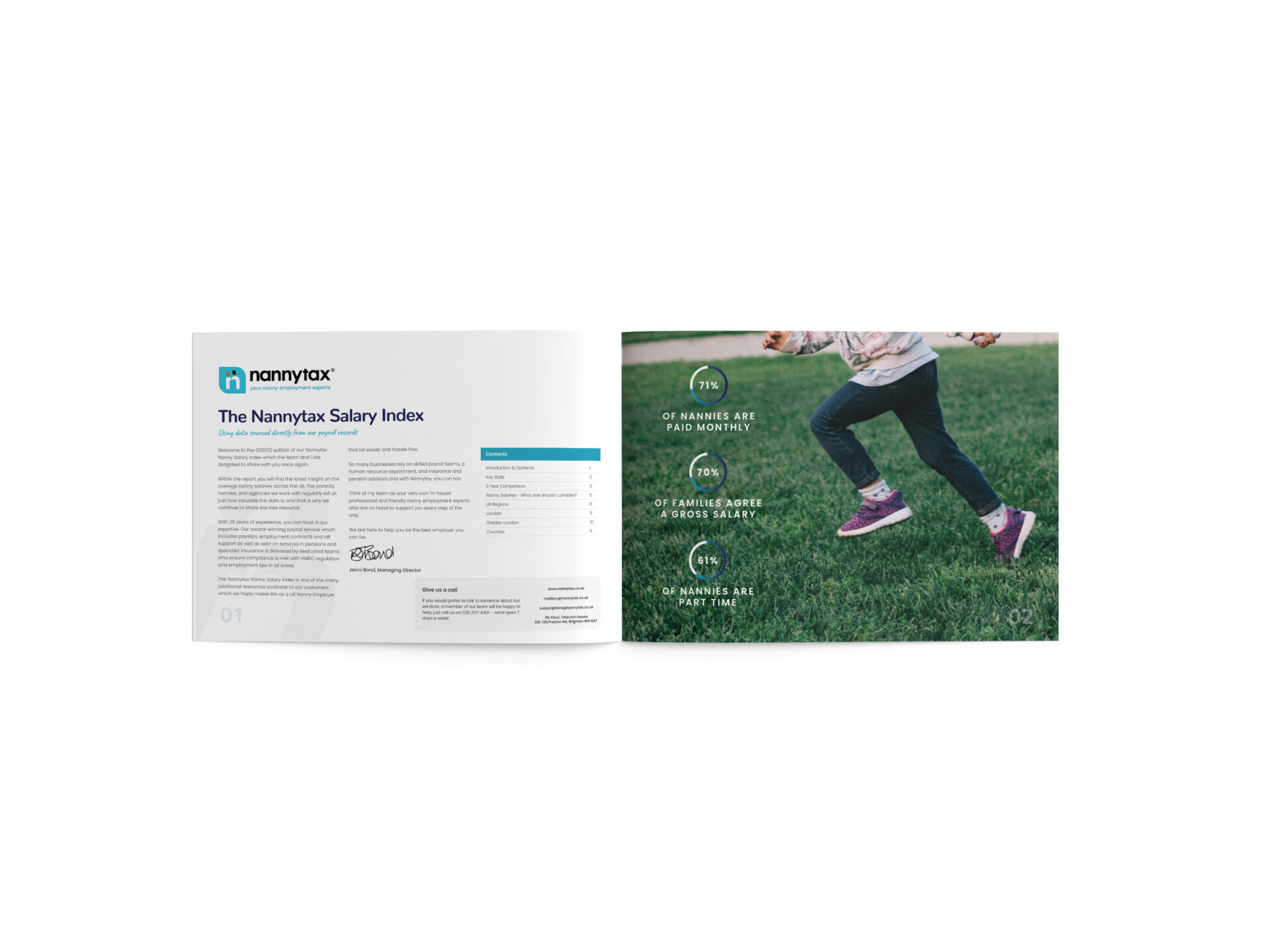

Nannytax Payroll Services for UK Employers - Nannytax.

. Your estimated take-home pay is. A household employer is responsible to remit 765 of their workers gross wages in FICA taxes. Home Buy Now Tax.

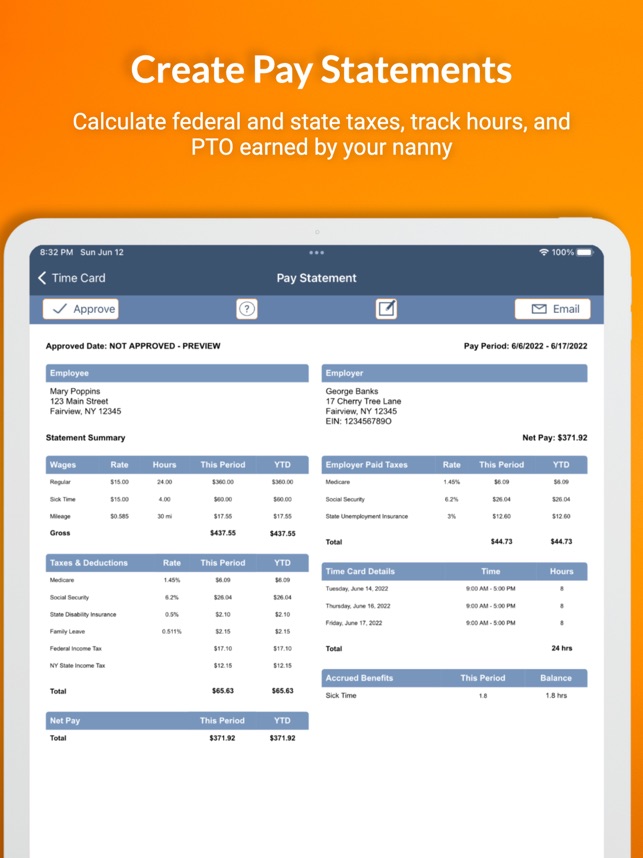

Our nanny tax calculator will help you to calculate nanny pay and determine your tax responsibility as a household employer whether paying a nanny a senior care worker or other household. The complete candidate document package will be submitted to you following the placement. Nanny Tax Hourly Calculator Enter your employees information and click on the Calculate button at the bottom of the nanny tax calculator.

This is a great place to start. Nanny tax and payroll calculator BUDGET ONLY PAYCHECK AND BUDGET Our easy-to-use budget calculator will help you estimate nanny taxes and identify potential tax breaks. This gives you an accurate picture of the tax and.

The nanny tax is a combination of federal and state taxes families must pay when they hire a household employee such as a nanny or senior caregiver. Nanny Tax Calculator GTM Payroll Services Inc. You can also print a pay stub once the pay has been.

Nanny Tax Calculators Please use one of our two nanny tax calculators to determine the correct wages and withholdings for both hourly and salaried employees. Nanny tax calculator uk 2020 Wednesday June 22 2022 Edit. This breaks down to 62 for Social Security and 145 for Medicare.

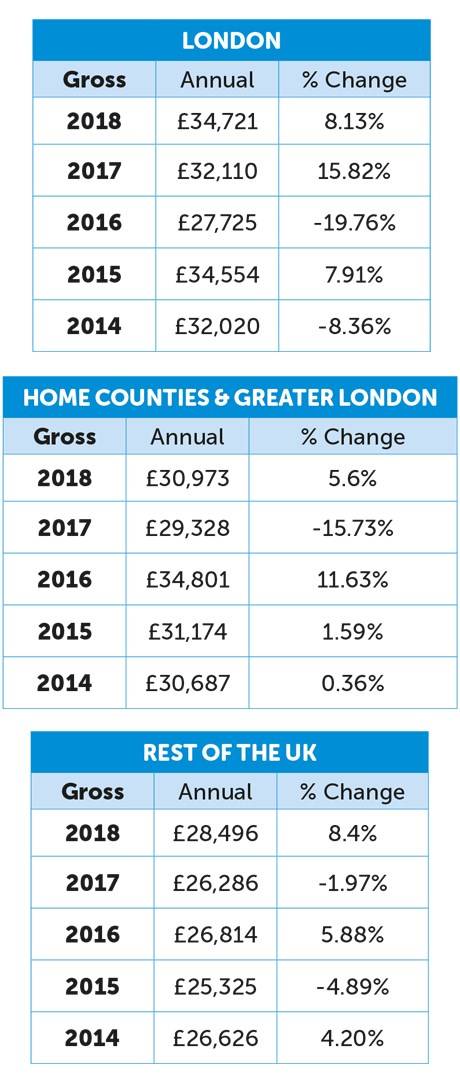

Nanny Tax Calculator Leading Nanny and Maternity Nurse Agency UK London - myTamarin The Nanny Tax Calculator This calculator will help you understand the total cost of employing a. New company providing payroll services and all required Revenue returns including PAYE modernisation for families who employ nannies or childminders in the UK. Enter a gross figure into our free nanny calculator to see the nannys tax based on their personal tax situation.

Nanny Tax Calculator Use GrossNet to estimate your federal and state tax obligations for a household employee. Good news though NannyPay offers a low-cost and up-to-date software solution for calculating nanny taxes and preparing annual Form W-2s and Schedule H up to 3 employees at no. Agreeing the appropriate mileage rate with your employee is an important part of their contract with you.

Estimate your Income Tax for the current year Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2022.

Nannytax Nanny Payroll Services For Uk Employers Nannytax

Income Tax Calculator Find Out Your Take Home Pay Mse

Nanny Tax Payroll Calculator Gtm Payroll Services

:max_bytes(150000):strip_icc()/PayrollbyWave-8c71e0803325490eb91db609fe4449a2.jpg)

The 8 Best Nanny Payroll Services Of 2022

Nanny Salary Pension Calculator Gross To Net Nannytax

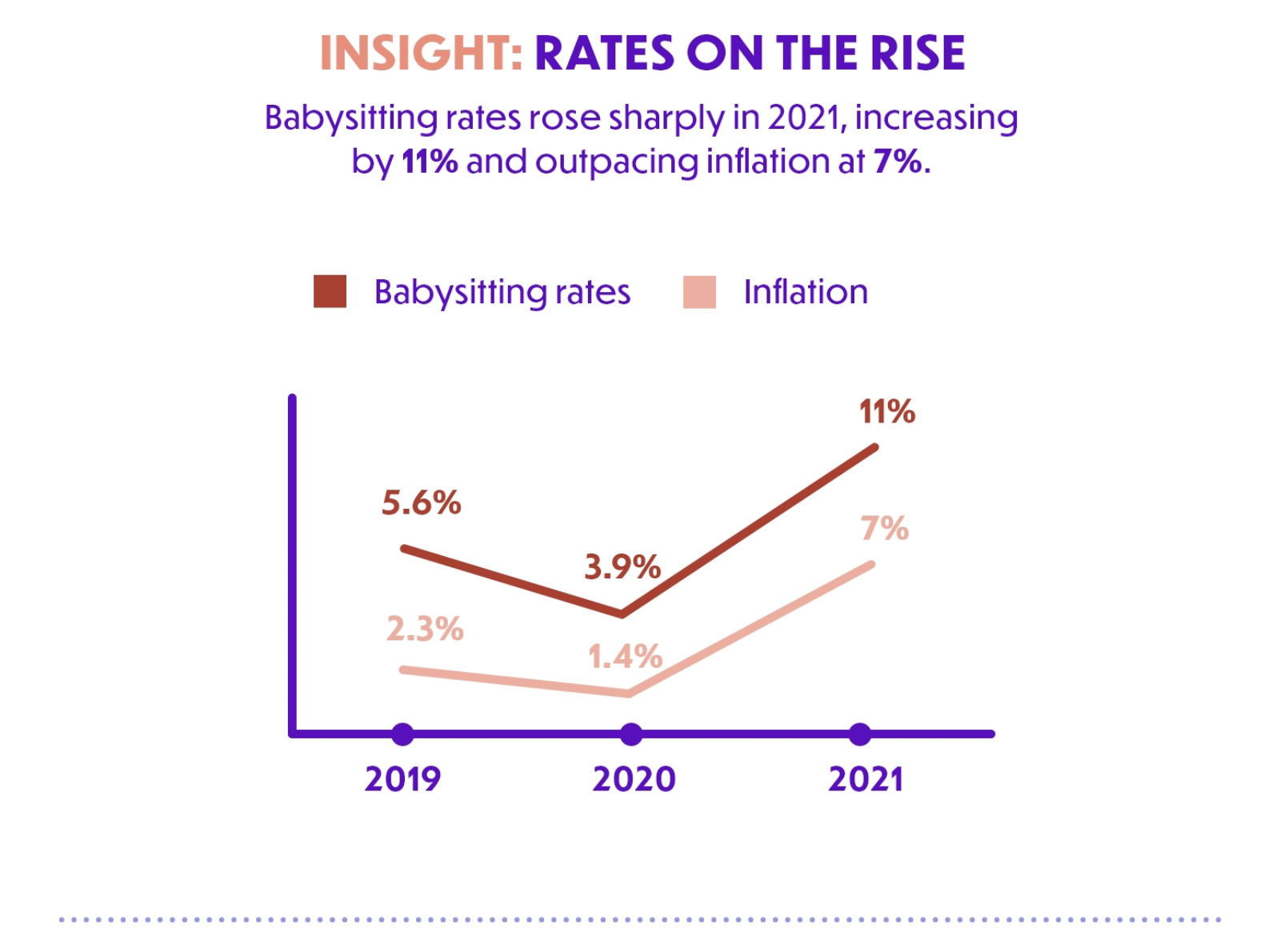

How Much Does A Nanny Cost Nanny Salary Index 21 22 Nannytax

![]()

Nanny Payroll And Tax Experts Tax Calculator Nanny Matters

Guide To Paying Nannies Over The Table Reducing Your Taxes Sittercity

Nanny Tax Payroll Calculator Gtm Payroll Services

Nanny Tax Payroll Calculator Gtm Payroll Services

Uk Salary Tax Calculator Uk Salary Tax Calculator

The Child Care Credit And Your Us Expat Tax Return When Abroad

The Salary Calculator Take Home Tax Calculator

The Ins And Outs Of Nanny Tax Taxscouts